What is House Hacking?

An off-market rehabbed Pilsen 4-Unit listed by Kevin Rocio.

How to live nearly rent free in some of Chicago’s hottest neighborhoods (& yes, with upgrades that nice).

For most young Chicagoans, the idea of renting an apartment in a 4-unit walk-up seems more feasible than the idea of buying the entire building. However, as rents continue to grow, first-time home buyers are snapping up these multi-unit buildings with a minimum down payment and living nearly rent free. This phenomenon is known as house hacking & we’ve partnered with Kevin Rocio, house hacking master (oh, and head of @properties #1 Commercial Sales Team nbd) to help you learn about one of our favorite types of investments.

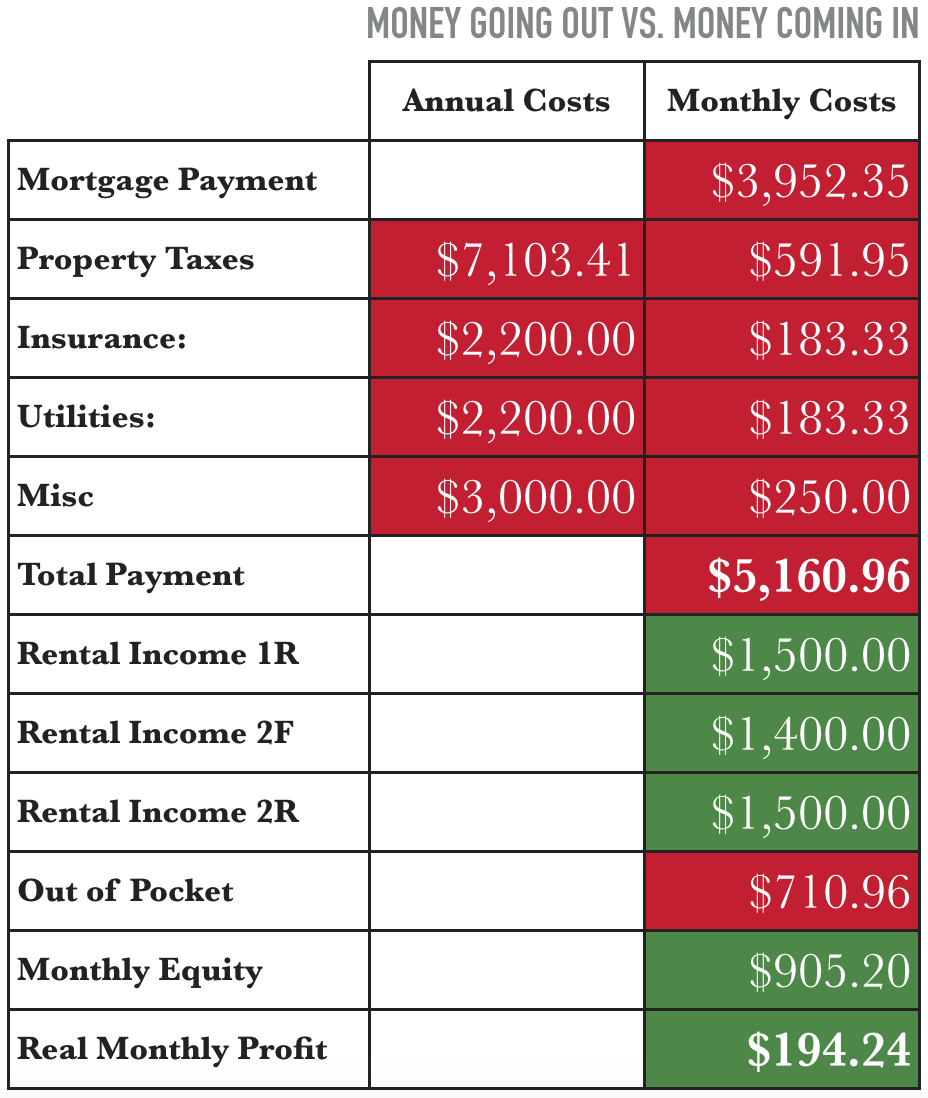

While it might sound like a hoax, Kevin & his clients have been house hacking for decades and making a lot of money while doing it. Plus, the allure is clear—more house for your money. Financial modeling from Joe Burke, Vice President of Mortgage Lending for Guaranteed Rate, shows that the rental income in this off-market 4-flat in the hot neighborhood of Pilsen (yes, the fully updated one pictured throughout this post) could reduce the typical home buyer’s out-of-pocket payments to under $720, even after factoring in general maintenance like snow removal & landscaping.

An off-market rehabbed Pilsen 4-Unit listed by Kevin Rocio.

BUYING BREAKDOWN

Joe breaks down what the monthly economics look like using his company’s “Home 4” program. It allows 5% down for a 4-unit owner occupied property. With a purchase price of $775,000, this fully-renovated Pilsen property is perfect for anyone that wants to start their real estate empire with a down payment of $38,750 (Closing Costs not included).

But, being a landlord isn’t for everyone. The biggest challenges are picking the right tenants, knowing the laws and understanding that you’re running a small business. I recommend that every new multi-family investor enroll in the Property Management Training Program ran by the Community Investment Corp., a nonprofit Chicago lender that finances multifamily rehabs.

Since 2009, CIC has seen a 150% increase in enrollments of its’ course by new landlords.

An off-market rehabbed Pilsen 4-Unit listed by Kevin Rocio.

As a team of multi-family investment specialists, Kevin’s team speaks with individuals and young couples who don’t want to feel that they’re missing out on this real estate bull run that we’re in. This is especially true with the tech-savvy millennial with an entrepreneurial side. They don’t want to buy a condo or single-family home because they’re not sure how long they will call Chicago home, but they also don’t believe in throwing away money on rent and not seeing a return for it.

While the last recession temporarily sidelined many folks who would have been first-time buyers, they’re back in the market in droves, regardless of the scarce inventory. This has resulted in the daunting task of getting an offer accepted.

“At the first-day showing, there was a line out the door,” says Karen, 30, a self-employed product designer. The property listed at $525,000, and after a hasty post-showing debrief at Starbucks, the couple made an offer the very same day — $13,000 above the asking price. Their final offer hit $587,500.

Success Story

Back in June 2017, newlyweds Joe and Scot returned from their honeymoon to a surprising business proposition from their downstairs neighbors, Mark & Chris: go in together on a 4-flat and rent out the other two units.

“Our life could’ve just continued to be this migration of rentals along the Blue Line — Wicker Park, Bucktown, Logan Square,” says Chris, 34 and a fitness trainer. “Our rent kept getting raised, and we just saw this future of getting priced out and moving further out every year.”

This past September, the three closed on a stately brick 4-flat in West Humboldt Park, paying the $999,000 asking price. They say schools in the developing neighborhood aren’t a concern for now, since neither couple has children. If their families do grow, the couples point to the building’s versatility. They could duplex two units for more space or move elsewhere and rent out the building as an investment property.

“There is no way we could have afforded a single-family,” Scott says. “So, it’s a little ironic that being tied to a mortgage has made us more flexible than renting.”

House Hacking Tips:

Buy Low: Right now, Kevin’s top five areas for house hacking are: Pilsen/Albany Park (tie), Rogers Park, Edison Park & Jefferson Park. His next five favorites are South Shore, Uptown, Avondale, Belmont Cragin and Edgebrook.

Move Fast: Investors with deep pockets are making cash offers within days of listing. Call Joe and get pre-approved for a mortgage, acquire a feel for the market and be ready to make an offer quickly. Ask our team for our neighborhood property reports to understand the inventory and pricing.

Know Your Loans: Lenders don’t assume that 100 percent of rental income will go toward your mortgage payment. Work with a lender who specializes in multi-unit properties, one who can walk you through the math like Joe from Guaranteed Rate.

Current Tenants: If the building has tenants, get full disclosure on their lease agreements. If a seller says occupants will be gone by a certain date, confirm it with the tenants before signing anything.

Be a Serious Landlord: Learn the local rental laws. CIC offers property-management courses that cover the basics for $50. Above all, screen your renters thoroughly by soliciting recommendations and credit checks. Even if it’s your cousin, put them through the same process.

Happy House Hacking.

For more information, join us at our next Sip & Learn: House Hacking.

Originally written by Kevin Rocio & edited by Kourtney Murray.